Project Description

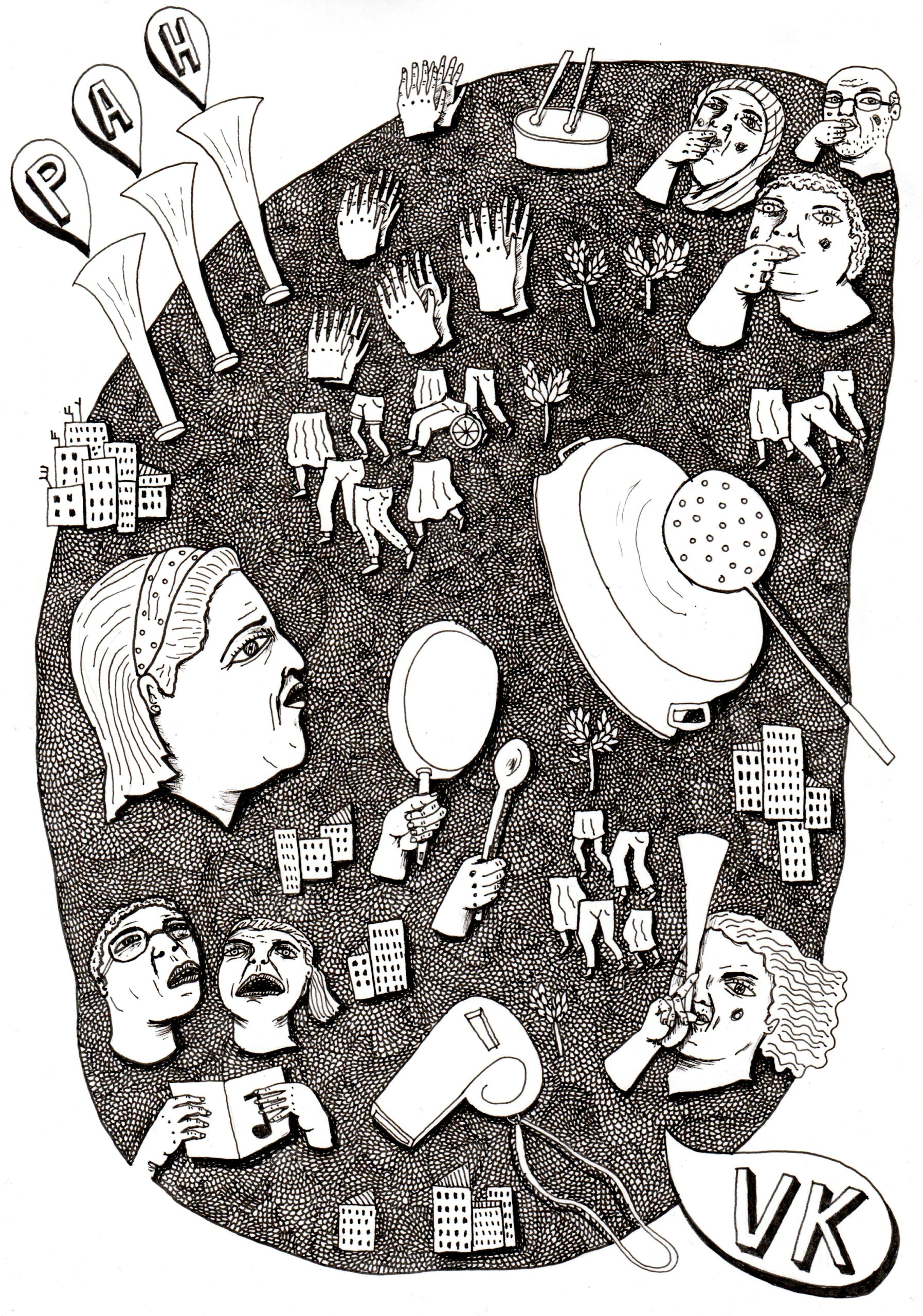

Here you’ll find chapters 3 to 6 of “Until the Patriarchy Falls and There Are No More Evictions. Debt, Housing and Patriarchal Violence”, written by Myrian Espinoza Minda and Lotta Meri Pirita Tenhunen in dialogue with PAH Vallekas’ Women’s Group, illustrated by Coco Guzmán and now translated by Liz Mason-Deese.

The research and writing process of the booklet were funded by the Rosa-Luxemburg-Stiftung, Madrid Liaison Office and the Foundation for Arts Initiatives.

We hope you’ll enjoy the translation and find it useful in your struggles.

3. The Consolidation of the PAH: Its Objectives and Feminine Face

The PAH’s effective consolidation in all Madrid’s neighbourhoods was the result of the social eruption following the demonstration on May 15, 2011 (under the banner: “Real Democracy Now. We are not commodities in the hands of politicians and bankers”), which gave rise to encampments in what came to be known as the movement of the plazas or the 15M movement. The encampment was largely inspired by Tahrir Square, part of the “Arab Springs”, which, starting in 2010, demanded rights and freedoms in countries of North Africa and the Middle East. Without a doubt, the 15M revolutionized Spanish society and the way of doing politics, but here we will limit ourselves to discussing the impact of a movement that camped in the Puerta del Sol with the precise chant, “We don’t have a house, we’re staying in the plaza”.

After the decision to dismantle the Acampada Sol in June, assemblies were created in all neighbourhoods of the city and many new initiatives were founded around the demands for social and economic justice that had been debated during the encampment. Almost all of the neighbourhood assemblies created 15M housing commissions. At first they primarily organized to stop evictions using their bodies and exercising peaceful civil disobedience in a house’s doorway on the day of the eviction, which has come to be called a picket or a “Stop Evictions” action. In 2013, the 15M-Vallekas housing commission started calling itself PAH Vallekas and joined the Platform, which came to include up to 250 local nodes at the height of that 2013-2015 period. In parallel, organizational practices of collective counselling and accompaniment and direct action, as well as the group’s objectives – dation in lieu of payment, social rent, and total or partial debt forgiveness – were consolidated during that time.

Collective counselling has been the cornerstone of the PAH’s organizational form from the beginning: “As a result of the collective and volunteer work of many people and occasional help from different legal professionals, along with the practical experience of […] years, the PAH has accumulated detailed knowledge of the procedure that starts when a mortgage stops being paid”.1 The collective knowledge accumulated in the struggle is poured into the PAH assemblies, in which new arrivals and those who have already been there for some time can explain their housing problems, share their personal situations, and resolve their doubts, while also learning how to teach and share the acquired experience and knowledge to other compañeras. In this sense, collective counselling has nothing to do with professional legal counselling based on a contracted service.2 Like any space of situated knowledges, collective counselling has its strengths and weaknesses, however it is an essential part of building a grassroots movement that seeks autonomy from professional knowledge that is not available to everyone and from whose point of view would have given up for lost many of the battles that we have waged together before even trying. Needless to say, as women, we particularly understand collective counselling as a space that teaches us to trust in the wisdom of compañeras who have been in the struggle for longer, as well as allowing us to feel their empathy. One of the most oft repeated phrases in collective counselling is “You are not alone”. For many women, this becomes true over the course of time, when PAH Vallekas becomes part of the family and, although they have come because of housing problems, they end up staying due to the group solidarity, which encompasses many more fields.

Accompaniment is a one-time or longer term commitment between the person affected by a problem and one or more compañeras. It seeks to collectively take one or a series of concrete steps in struggle. In the Libro Verde de la PAH and PAH: Manual de instrucciones, accompaniment is described as a situation in which compañeras with more experience come to support and help in negotiations with the banking entity. As the movement grows and encompasses increasingly more social justice issues related to housing, accompaniment starts to be carried out in many other areas: to request registration in the municipal register and other administrative procedures, to deliver documentation to the bank or court, to demand our records from social services, for court summons and requests for legal aid, for the first days and especially nights in recovered houses, to learn how to access resources on the Internet, to fill out forms and send requests, and much more. In short, it means dedicating time and presence, being there for others providing practical and emotional accompaniment. It requires, but also generates, confidence and teaches that anyone can help and be helped.

“Dation in lieu of payment” is a concept specific to the mortgage arena. It is an agreement between the debtor and the creditor to settle the remaining mortgage debt by handing over the property acquired with the loan.3 As a political objective it requires some explanation because, since it implies the loss of the mortgaged home, at first glance, it seems more of a defeat than a victory. Given the conditions in which the Spanish mortgage crisis was handled, dation in payment quickly became one of the most important objectives, because Spanish mortgage law4 gives the creditor bank the priority in purchasing the auctioned home. This leads to purchases for a minimum fraction of the mortgage’s value and systematically creates situations in which people and families are evicted from their homes while maintaining most of the debt that they incurred for the purchase. Additionally, the debts acquired during the years of the mortgage bubble were often extremely high, due to inflated real estate market prices and because they tended to cover 100 percent of the cost. Dation in payment as a political objective demanded the cancellation of remaining debts after the creditor took possession of the property and, in campaigns for a legislative change, demanded retroactive effects for those who had lost their homes but were still burdened with a lifetime of debt.

Social rent is an objective that, in the PAH’s first years, tended to accompany the demand for dation in payment. It arises so that the home already created in the mortgaged house will not be lost when the bank takes it: it means that one can keep living in the same house, no longer as an owner, but rather as a renter. As a general criteria, it should be a very low-cost rent, whose monthly rate is fixed according to family income (between 10 and 20 percent and in no case greater than 30 percent, which is the limit used by the United Nations in its definition of abusive rent). Several of the mortgaged compañeras from PAH Vallekas who, in their day, obtained dation in payment continue living in the same homes after negotiating the dation in payment and social rent paying a small monthly rent. Social rent was not invented by the banks nor is it an established legal category in Spain: it is a concept that was born in and for struggles. Later we will see how it has evolved as the casuistry of the PAH’s struggle has expanded beyond mortgages.

Debt forgiveness can either be full (also called debt cancellation) or partial (known as release) and it involves an intense and tireless struggle in which the tenacity of the particular mortgaged individuals plays an important role. Partial forgiveness or release, while a more difficult objective than dation in payment, is somewhat easier to achieve than total forgiveness. Agreements have been reached with banks in which the house is over with dation in payment and the remaining debt is restructured with a release and sometimes its conversion into another type of credit. These were useful in cases in which there were possibilities to pay after the debt conditions improved markedly and in cases in which much of the debt had already been paid off. Obviously, far from assuming any kindness on the part of the creditor banks, what was achieved with the releases was a small adjustment in the relation of forces between debtors and creditors. Similarly, we could have seen a very different situation after the mortgage crisis if the policies applied by the government had been aimed toward a social bailout instead of bailing out the banks. Associació 500×20 provides us this example: “Debt removal or partial forgiveness has been one of the formulas that some countries such as Iceland applied to households instead of saving the banks”.5

The compañeras who supported the PAH’s consolidation in Madrid participated in defining these practices and shared objectives through their vital shipwrecks. There are clear signs indicating that the experts in mass mortgage debt sought out two social groups in particular: migrants and women. They recognized that these groups had a greater need for stability, since they had many children, and a home was a symbol of putting down roots in the new society; they had a more urgent need to reduce housing expenses, as had been promised by a mortgage as opposed to rent, due to the sex/gender wage gap, and because in many cases their families depended on economic contributions in their country of origin and they had few support networks in their destination country; and because they were willing to work in anything: without access to the privileges of class and whiteness,6 with immigration law always lurking, they were in a clear disadvantage in the labor market, but they would accept any form of exploitation in order to not leave their family without housing. The elevated risk of non-payment, hidden in misleading advertising and public speeches of politicians who said that the price of housing “would never fall”, was not a concern, business laid in selling those mortgages in financial markets, making wagers for and against their collection, and, in the case of nonpayment, recuperating the house and collecting the remaining debt, which would be inflated since it was tied to a mortgage in a bubble moment.

Our intuition, our own experiences, and the stories that we have shared with one another point to the fact that they have sought us out for debt for a long time and demand it of us with special viciousness. There is a significant gender bias in how banks have managed the mortgage crisis. In this sense, writings on micro-credit in Bolivia resonate with us, as they have emphasized financial planners’ preference for signing loans with women.7 We can affirm that we have had similar experiences in Spain, such as the practice of including non-cohabiting female relatives as co-signers of a mortgage instead of guarantors. Many compañeras confirm having suffered this change to the contract without prior notice. They have found themselves in front of the notary on the day of signing and have been pressured to accept so as to not lose the loan. This led to tension in affective relationships between the people involved and has threatened many women’s family networks.

This also explains why women make up the majority of our movement: women’s economic conditions are worse (due to the wage gap, types of employment and contracts, care responsibilities that limit availability and forms of work and promotion) and it is women who take responsibility for the family in cases of the partner’s economic and affective abandonment (and as single mothers they face an even greater economic disadvantage due to the lack of equality in the labour market and the double care burden). These two patterns are frequently expressed in the collective counselling sessions. Due to everything we have had to live through as indebted women, we seek out alliances, particularly with other women. Among women with desires to collaborate, the solutions and escape paths become feasible and tangible. We see ourselves reflected in the face and gaze of each of them, as if they were mirrors. The need to follow the steps of other women who have suffered the same thing and the desire to be accompanied by compañeras are the first signs of what later comes to be the sense of sisterhood within the PAH. We also think that the feminine composition plays a role in how the PAH opens up space for feelings in the assemblies and counselling sessions, it creates space for sensitivity (misunderstood and scorned in patriarchal society, often attributed to women although it belongs to all of humanity) in politics, which we see as a strength, not as a weakness. In a movement that runs counter to that which put us into debt, in the PAH we started to unlearn the mandate of finance (enabling all forms of extraction of vital forces to pay off debt and crying about our exhaustion in secret) to internalize the PAH’s cause: debt is a scam, if I cannot pay, I won’t pay, I want to pay what is fair. Through this form of organization we gained confidence in ourselves in a way that later allowed for pushing for change on other vital terrains. We learn that the path is made by walking, we unite forces, we follow and share advice that is the most replicable and accessible possible, we think and debate, we manifest our differences in thinking and feeling. We, along with many others, gave birth to the PAH in that convulsive time of the awakening of the squares.

4. The awakening of the plazas reaches far in time and distance

Other women, with whom we later became comrades, experienced the bursting of the mortgage bubble differently. They were younger and without the burden of such decisive economic responsibilities such as a mortgage or children who needed care. But, the 15M – the awakening of the plazas – also stands out for them among the events of those years. Some of them were even so young that they do not remember much of the encampment itself in the Plaza del Sol. However, they recognize that their politicization, a few years later, was marked by the 15M as a trigger of a new political cycle: the idea of changing everything (not only what was possible within the parliamentary representative system) and the importance of making an effort to engage in politics with people who are different from oneself (and with those who had not had previous political education). These two elements made up an important part of the foundations of their political practice.

One of the youngest compañeras, Carla remembers certain confusion about the Acampada Sol: “I was 15 years old, I was a teenager and it was a sort of strange time”, she comments laughing. She participated in the 15M protest, and the critiques that emerged of the parliamentary representative system and the complicity between bankers and politicians seemed important to her. “I was not politicized but I had philosophical sorts of ideas floating around in my head and it seemed bad that they were cutting public education and health care”. Later she looked for ways to contribute in Acampada Sol but did not join any of the commissions. She did not start actively participating in any collectives until she went to university where, in 2013, she found the student movement, particularly the collective Toma la Facultad. “We were always doing something. We wanted to find other ways of organizing things and we demanded that students be able to participate in decision-making along with the university workers”. It was also in the university where, years later, Carla was introduced to the PAH: the student movement turned to collecting signatures for the regional popular legislative initiative (ILP) that proposed a legislative change in regards to housing in the Community of Madrid.8 Carla, the daughter of native Spaniards, could pay for her college studies without going into debt and she stayed in her home of Madrid. She did not experience housing problems or sexist violence in her family of origin.

Mina, another one of the younger compañeras, had gone through some of each in her childhood along with her mother and youngest brother. Mina’s father psychologically abused her mom, especially taking advantage of her vulnerability due to being economically dependent on him. A few years after the birth of Mina’s little brother, her father left her mother for a younger girlfriend (whom he would abandon a few months later for a younger one and so on for the following decades). However, the abuse continued despite the separation: her father had considerable social skill and quickly convinced much of their shared social environment that he had been the victim of infidelity and economic blackmail in the separation, instead of her mother. Meanwhile, Mina’s mother – who had put off finishing her degree so that the father could first finish studying to be a doctor, which would supposedly mean a higher income for the family – attempted to make ends meet with two young children and the minimum income as her only monthly income. The father did not take responsible for mandatory child support, exactly the opposite: the money issue became the common thread of Mina and her brother’s relationship with their father. The father lived alone in a three-room attic in an architecturally important building of their small city. The mother, with Mina and her brother, lived in a small ground-floor apartment, in which the children shared a small bedroom and she slept in the kitchen-living room. The weekend visits with their father turned into true battles of economic blackmail: their father would warn Mina and her brother than any action or attitude that he did not like would result in their mother never receiving the very necessary child support. The mandatory visits took place in an environment lacking affection and without their father’s true presence. Mina very quickly realized that her father was exercising physical violence against her younger brother. She never dared to tell anyone because of the consequences that her father threatened her with. “But he never laid a hand on me” Mina recounts. “I always got in the middle to defend my brother, but my father separated me, saying that I was a girl and he wasn’t going to touch me”. She remembers with particular bitterness that “gender school”, in which she thinks her father tried “to make a man out of my brother, who was so sweet and affectionate”.

When Mina turned ten, the long legal dispute over custody ended with her mother giving in, relinquishing custody of Mina to the father and keeping her brother. Thus, the father was released from child support demands, although the two children continued living with their mother. Shortly after, Mina’s father left for Canada with a research position and already sporadic contact became nearly non-existent. Those years left their mark on Mina, in such a way that as she grew up she felt an extreme need to be independent, especially in economic terms. At 15 years of age, she started to work some afternoons distributing advertising and during summer vacations she washed dishes and cleared tables in a gas station cafeteria. She went to live by herself as soon as she could. At 18 years of age she moved in with a boyfriend. “I thought that by getting together with him I would get out of the economic dependence that I had felt with my father” she explains, “but soon it was almost worst”. They went to live in the country’s capital where Mina did not know anyone. “I often ask myself what I did with that year of my life”, Mina says. “I worked in a hamburger shop and acted as a girlfriend, nothing else”. The relationship did not last. She realized that both the price of rent, which implied major economic pressure, as well as strong social pressure pushed her to live in a couple. Mina came to the conclusion that seeking autonomy through romantic relationships did not work and, during her first years of university, she went through an intense questioning of the heterosexual couple and traditional family. She had always identified as bisexual and her interests were increasingly marked by reflections from the many gender dissidences. When she first landed in Madrid, in May 2011, seeking contemporary reference points in women’s struggles, she was drawn to the autonomous feminist movement, in whose collective work she saw reflections of many of the things that she had thought about alone.

As fate would have it, Mina’s trip to study feminist practices and revolutions was transformed when, in the midst of the eruption of the 15M, our compañera ran into Acampada Sol. Between the excitement and diversity of the political issues being discussed, she became especially interested in the mobilization of the Plataforma de Afectados por la Hipoteca [Platform of Those Affected by Mortgages], which was in the process of organizing itself by neighbourhood. When Mina returned to her life far from Madrid, in northern Europe, she continued watching what was happening. Specifically, she got hooked on the livestreams from PAH’s civil disobedience actions. In those actions, the affected people took over bank branches to pressure their directors into accepting dation in lieu of payment or debt forgiveness. What most surprised Mina was that the actions seemed joyful and festive. “It was like they were celebrating being together, as if they were happy for having found one another” Mina describes it. “I really liked that when they spoke in public, you couldn’t sense any tone of victimhood”. When we asked Aisha about this issue, she confirmed that in the actions she felt that personal concerns faded, at least for a few hours. Like Aisha, the majority of those who participated in taking over bank branches at that time were people with mortgages.

The streamings also showed pickets to stop evictions chanting “We will not tolerate one more eviction”, demonstrations calling out the politicians guilty of speculating with housing to the cry of “We are not commodities in the hands of politicians and bankers” and “We have a solution: send the bankers to prison”, and protests to demand “The right to housing now”. Those slogans reached Mina, despite the distance separating her from the physical action: they stirred up memories for her, echoes of her childhood and adolescence with a precarious single mother and housing problems, which were her daily bread. She remembered moving every year and the omnipresence of the exhaustion that this meant for her mother. Now, as an adult, Mina saw that there was a world, an idea, a group of people clamouring: “If you don’t have the means, don’t pay”, “If you have to choose between eating and paying off your house, eat”, and “Housing is not a commodity, it is a right”. “I spent months excited in front of the screen. My blood boiled because of the injustice, but I was also encouraged by seeing people supporting each other”, she says. And, little by little, she decided: she wanted to return to Madrid to be able to get involved in that movement. She organized her migration to Spain with support from the university studies she had already started.

In the Puerta del Sol encampment she had become friends with people who inhabited an occupied building in one of the most touristy areas of central Madrid. They accepted her as a visitor and thus she returned to Madrid with the dream already established in her head of staying to live. It took her a few years to make her dream a reality and during that time of refusing paid work – due to prioritizing her studies and political education – she acquired nearly 15,000 Euros in student debt, which she allocated to daily expenses. To this day, most of that debt has not been paid off.

5. Privileges: South and North Migrations

When we compare the trajectories of Mina and Aisha, two compañeras whose countries of origin are in the Global North and South, it is easy to see how privileges of class and whiteness and the global North-South division are at play in migration. They both identify the desire to improve their life as the reason why they migrated, but what that abstract definition means is determined by the social place in which they were born. In terms of their arrivals, Mina hardly encountered any obstacles when she decided to make her life in Spain. The student debt that she acquired in her first years outside of her country of origin was guaranteed by the State, which implied a lower risk, although it is still a debt to cover basic needs. On the other hand, Aisha, after reaching Spain, spent five years in the uncertainty and vulnerability of living without documents. As a European Union citizen, Mina was, from the beginning, guaranteed the same labour rights as Spanish workers, thanks to European Union conventions. Aisha, for her part, could not travel to her country of origin until she regularized her situation, because she would not have been allowed to return to Spain. Mina, on the other hand, could freely travel any time, whether to take advantage of job offers in her country of origin (where they were and are better paid, which allowed her to maintain herself for long periods in Spain) or to visit friends and family (which enabled her to have greater support in her community while she was still building new support networks in Spain).

The differences that we can observe in these two migration experiences respond, in turn, to historical and geopolitical differences. When Aisha migrated from South America, her country, Ecuador, had been led to a major financial, socioeconomic, and political crisis.9 In this crisis – like earlier ones in South America and Africa, and crises to come in North America and Europe –, mass indebtedness following the liberalization of the financial sector played – and would play – a fundamental role. Jamil Mahuad’s government proposed the dollarization of the sucre, the national currency, as the way out of the crisis. It was only a solution for business leaders with large bank loans whose debts were thus significantly reduced. However, at the same time, it crushed workers, families, and peasants, whose wages, savings, and pensions were reduced to a fifth of what they had had. This situation caused an emigration exodus, of which Aisha was a part. It had nothing in common with the situation in which Mina would decide to head to Spain a decade later. When she migrated, she did so from a country that found itself on the winning side of the European crisis of private (of families) and sovereign (of States) debt. She made a decision that responded to other needs, but it was not due to the push of impoverishment and future misery that Aisha would have found herself in if she stayed. We even see a structural difference in the motives that led these two women to migrate: while Aisha’s reasons for migrating revolved around poverty and the care burden imposed on her in her family of origin, Mina’s reasons had to do with wanting to escape from more subtle forms of family control. Mina names her search as a desire for another type of community, an environment in which to express herself and relate to others with more freedom. Rather than supposing an economic improvement to life, it involved accepting greater levels of precarity, since in Spain she also found herself dealing with the effects of the financial crisis. Furthermore, for Mina, staying to fight for the life that she desired involved a more manageable economic risk: if her migration project failed, she could be assured of an economically sustainable return, which was not the case for her compañera Aisha.

These starting differences are even more accentuated in other stories, such as that of Gicela, a compañera who migrated due to rape and harassment. Gicela already had her life put together in her country of origin. She was economically stable thanks to a small ice cream shop business, which allowed her a certain amount of autonomy after separating from the father of her four children, who had abused her for thirteen years. The new problems started when an unknown man fixated on her: he parked his car in front of her ice cream shop and whistled at her. He started sending her notes through a common friend, saying they were from an “admirer”. She did not read them, she would tear them up and throw them in the trash. She was clear that she was not interested in him and clearly communicated this with the friend playing messenger. One night, one of Gicela’s friends invited her to go out and she agreed, but when they reached the club, she introduced her to the man who had been sending her notes. Thus this story of planned sexist violence and victim-blaming continued to unfold like so many others. Gicela drank a soda with him to be polite and then tried to go home. A bus driver by profession, he offered to take Gicela and her friend home. Gicela said that she would walk. He insisted. Finally, the two got on the bus. He took her friend to her house first and Gicela had a bad feeling when she was left alone with him on the bus, so she asked to be let off right there, but he didn’t let her. He drove by Gicela’s house to a vacant lot, where he parked the bus and raped our compañera.

The fear of the feminicidal rapist is interwoven into Gicela’s account: “You don’t think anything at that moment, you only wonder if he’s going to kill you: ‘Is he going to kill me? Is he going to kill me?’ The fear completely eats you up”. Later, the sensation of guilt for having used whatever occurs to you in the moment to get out of the situation. Gicela tells us: “Afterwards, I noted that it stank and I felt guilty. But there, at some moment, I started thinking about Camargo10, the times of Camargo, and I was afraid that he would kill me. So, before he got off me, I said to him…, since I thought he was going to kill me, I told him that I thought that we knew each other, that we should do it differently, not by force… And he said he was in love with me”. Even worse, the rapist blamed Gicela for having rejected him for a long time, while he was sending her notes; she was guilty of not having obeyed desire and, ultimately, male power. “I had to use my intelligence to mould myself to that person in that moment. Fear makes you do many things; no matter how much you have read, how well-informed you are, when you are in that moment you don’t think about that” our compañera describes the calculus she made to survive while she was being raped.

Gicela survived, but from that moment on, the rapist decided to make her “his woman”; just like that, like an object to possess. Everything pointed to him having planned the operation for some time, since he had met and even become friends with several people close to Gicela. She became depressed after the rape and her business soon went under. They had to operate on her and she went into cardiac arrest during the operation; when she woke up, after the resuscitation, she found her rapist beside her with a bouquet of flowers. “Everything was demonic” she describes, “after that, I would see him when I left the ice cream shop, when I went to buy something, to the bay, to the pharmacy…; wherever I went, that man was there”. He introduced himself as “her husband” when he asked the neighbours about her. Later Gicela learned that he had a family, a wife and children, and she was even more shocked by the normality in which traditional family life was interwoven with this operation of harassment and rape, apparently without any type of accountability. He pursued her across the city for months; he would appear in front of her house night and day, and he tried to rape her two more times. After two years of harassment, a family member offered Gicela the opportunity to travel to Spain. That was when she decided to leave to be able to live peacefully. She left her first four children in the care of their father and crossed the ocean.

When we look back at these different migration processes, we are aware that we decide to leave fleeing from precarity, structural poverty, the lack of community, psychological abuse, and sexual and physical violence. But all of these things could also be named in a positive sense, because it is also necessary to say that we decide to move because we yearn to live freely, to change the given order of things, and to change ourselves. However, in Spain we find ourselves – some of us directly and others more indirectly – affected by or completely entrapped in a debt crisis of which the politicians responsible for it decided to make us pay in a variety of ways that affect all of us.

6. The Bank Bailout: Capital against Life

The bank bailout landed in our lives by way of cuts in all social areas. “You all have lived above your means” was the politicians’ mantra while they directed public funds (existing and future funds, tied to public debt) to the bankrupt financial banking sector. That was how they justified the unjustifiable.

To offset the public investment in bankrupt saving banks and banks, to balance the enormous public spending due to mass unemployment, and to calm the attacks on the risk premium, which increased the country’s debt, a plan of cuts was deployed starting in 2010 that included reducing staff in health care, education, the public child and elderly care system, and social services. It also included health care reforms to exclude undocumented migrants from the public system, which, until then, had been universal, the sell of public hospitals, and public-private collaborations that meant directing public money to the private sector with dubious results. It meant the closure of programs, resources, and subsidies to alleviate gender-based violence, the suppression of funds dedicated to welcoming and attending immigrant persons, the elimination of partial benefits, such as those directed to the elderly, dependent persons, or unemployed young people; the reduction of the benefit for those caring for a dependent family member, introduced by the recent dependency law, which would supposedly form the fourth pillar of the welfare state – a law ended up dying before its implementation, because it prioritized rescuing the banks over caring for people and their carers –. It also meant increasing classroom size in public education, an end to aid for buying books, the closure of accommodations for students without resources, the increase in university fees, the non-hiring of interim professors, and the increase in prices for public day cares, and the list goes on.

In the area of the right to housing, the City Council and Community of Madrid sold the little existing public housing to vulture funds. In 2013, the Community of Madrid, presided over by Ignacio González, of the PP (right-hand man of Esperanza Aguirre who was later accused of corruption in the Lezo and Púnica cases), sold nearly 3,000 social housing units to the Encasa Cibeles society of Azora-Goldman Sachs. That sale was later annulled in 2020.11 The Madrid City Council, in October 2013, under the mayorship of Ana Botella, from the PP, sold 1,860 public housing units to two vulture funds from the Blackstone conglomerate. In 2018, the Court of Auditors ruled that that sale had been made below market price and “without specifications, without competition, and without carrying out an initial appraisal”.12 The right to housing had never been consolidated in Spain13 and, during the bubble, housing’s conversion into a business was exacerbated by the reform of the land law, the reduction of requirements to build, tax exemptions for buying, public investment in urbanization of new zones and renewal of the city center, and the lack of supervision of banks’ loans and action14, etc.

In Spain, there was complete bipartisan collusion – between the Partido Popular (PP) and the Partido Socialista Obrero Español (PSOE) – and the construction and real estate market (construction and real estate businesses, banks and savings banks, investment funds, and the management of public housing companies). Payments and donations to political parties in exchange for public works concessions through “commissions in B” and irregular contracts (the Gürtel, Lezo, Púnica, and the PP’s Caja B cases, among others) have been well proven. It was politicians who ran the savings banks that loaned money to builders who worked in and for the cities that they governed and, at the end of their mandates, many politicians joined the boards of directors of the companies that they had benefited (the famous revolving doors). Many Spanish politicians saw, and see, the real estate market (and related tourism market) as the economic motor of the country (and of their own political parties) and that sector’s needs have literally dictated the majority of laws that govern the right to housing in Spain. Furthermore, public authorities did not intervene in the face of the 245,641 foreclosures and evictions carried out between 2008 and 2010, because the banks were the ones that needed protecting; it is always capital above life.

In 2012, this situation led the PAH to present its political demands to the government, led by the PP, in the form of a popular legislative initiative (ILP). Following the wake of the struggle, it included three basic demands: legislate dation in lieu of payment with retroactive effects for foreclosures on first homes carried out during the years of crisis, stopping all evictions on first homes without housing alternatives, and the creation of a social rent park from the housing owned by banks that had been bailed out with public money. The ILP was supported by signatures from 1,402,853, almost three times the amount required for the parliamentary procedure and a record in the country’s history. The ILP was voted on in Parliament in February 2013.15 However, it was rejected and replaced by a mortgage law reform designed by the PP. The movement called the reform a farce to avoid addressing the root of the problem. It included a moratorium on mortgage evictions that could only be applied in some cases. Furthermore, at the legal level, it was not mandatory, but only a recommendation of good banking practices. However, since then, bad banking practices – expiring advance payment, abusive clauses such as the ground clause and interests according to the IRPH index16– have started to be investigated at the European level and later those interventions would lead to unflattering resolutions and institutional declarations for Spain.

When it became clear that the PP was not going to allow any legislative change that went beyond the cosmetic level, the PAH launched the “Obra Social” [“Social Work”] campaign.17 The campaign’s name was a play on the “social works” (institutions and funds directed toward social and cultural action) of banks and especially saving banks, whose malpractice and bankruptcy led to the mortgage crisis. It sought to access the common wealth that had been looted in the bailout through practices of disobedience. We began appropriating the empty houses owned by rescued banks: houses they came to own as a result of forced evictions, because they had remained closed since their construction to inflate prices, or because had been left unfinished because they belonged to bankrupt builders or real estate companies.

That is how we recovered those toxic real estate assets that for us meant the power to build a home and life project free from debt. In January 2012, the then housing commission of the 15M-Vallekas Assembly had already recuperated a building with 14 homes, owned by a company in bankruptcy (which would later go to Sareb as a toxic asset). In April 2014, after preparing for six months, PAH Vallekas took over two other buildings belonging to banks. A total of 15 families and people went to live in them, including our compañera Mina, who could no longer pay for her small room in a shared apartment, rented under an irregular contract. Mina’s scholarship had not been renewed and she had realized how unsustainable it was to go into debt to pay for basic housing and food expenses. She had decided to stay in Spain despite all of that and was going to fight to maintain her decision. The building in which Mina and three other families went to live belonged to Caja Madrid, the most infamous entity of the bank bailout (as we can recall, also owner of the Aisha and Libertad mortgages). Caja Madrid was the Comunidad de Madrid’s savings bank, headed by Miguel Blesa – personal friend of president José María Aznar (PP) – and whose board of directors consisted of politicians from different parties. Blesa developed an expansive policy of buying foreign assets, granting multi-million Euro loans to all the region’s businessmen, and high risk mortgages. The result was a colossal debt that was exposed with the 2008 crisis and Caja Madrid was bailed out with public money.

To rescue Caja Madrid and other bankrupt savings banks, the Spanish State created the Banco Financiero y de Ahorros (BFA, Financial and Savings Bank), an entity that, in legal terms, was an institutional protection scheme (IPS).18 It was a new type of apparatus, tailored to the needs of the financial sector.19 Under the BFA, seven savings banks20 that had been bailed out by the Spanish State were merged. This provided the banks with the State’s institutional protection through the IPS and consolidated the initial 4.465 million Euro loan of public money. This money was channeled through the FROB (Fondo de Reestructuración Ordenada Bancaria, Fund for Orderly Bank Restructuring), another custom-made structure21 that had been created a year before the IPS. Thus, while we were occupying all the plazas of the country chanting “We are not commodities in the hands of politicians and bankers”, Bankia was born, chaired by Rodrigo Rato (years later imprisoned for the black cards corruption case and currently being investigated for money laundering). In legal terms, it was a subsidiary of the BFA and, in practice, its commercial brand targeted toward retail clients. It went partially public in July 2011.22 Through Bankia, the key players of the savings bank mortgage scam returned to the fray with a new toy paid for by everyone, with the false promise of returning the millions lost. The squandering party continued and in 2012, the State invested 17,959 million more Euros from the European bailout in Bankia. In addition, Sareb used public money to buy real estate from Bankia worth 22,317 million Euros, of which the State has only recovered a small portion.

They had already understood that the account was paid for by others. It was paid for by society as a whole: the unending aid to Bankia and the rest of the banking sector was directly translated into cuts and public debt of the Spanish State. While Bankia requested millions and millions, it did not stop evicting families. One of the first who faced the threat of eviction by Bankia was our compañera Aisha, who in 2010 had been left alone with her daughter and was burdened by care work, depression, and an unpayable mortgage. To get an idea of the cynicism of the political goals proposed in those years,23 we only have to remember that, according to neoliberal logic, Rodrigo Rato and his company were attempting to fulfill their responsibility to society, that is, evict to clean up accounts and thus return the bailout money. They are aware of the violence that they waged and continue waging and that is why it is necessary to say that they waged a war of capital against life. And in the midst of that war, for many compañeras, the PAH was a way to keep going, a material support for life, a trench from which to continue fighting.

Like the 15M movement, the PAH proclaimed: “This crisis is a scam” and “We won’t pay for this crisis”. By sharing individual cases and learning the ins and outs of financial markets, we could argue that there should be any type of shame in “not paying”. They had used mortgages, with irregular conditions and abusive practices, to fuel a crazed banking system and it did not matter to them that we were not going to pay them back, because the business was in buying and selling debt in other financial circuits. With the granting of these crazed mortgages they inflated the bubble price even more, giving increasingly inflated mortgages, which no longer had any relation to their real value. Public powers had actively collaborated with the bubble.

When someone would come to the assembly crying – because they had to go without eating to pay for their house, because they hadn’t seen their children in days because they had several jobs, or because it was impossible to pay the full bill and that would lead them directly into the process of losing their house – we shared everything that we had learned. This allowed them to understand that it was not fair to be paying for the banking scam with their life, when, in fact, we were already paying for it with public bailouts, with a public debt that made all of us responsible without asking us.

The foundations of the PAH’s struggle were, since the very beginning, disobeying debt as “a standard condition of working-class existence”.24 First, dation in lieu of payment without debt: fighting so that losing ownership of the house would not end up in debt; banks had inflated prices by granting risky mortgages, we should not be held responsible for a debt that they had fueled. Second, fighting for social rent in that housing whose ownership had been loss; banks were being bailed out with public money, the least they could do was not leave their rescuers out on the streets. But, if social rent could not be obtained in that or other housing, Obra Social was a necessary tool for not being left on the streets and continuing to struggle demanding a social rent in the housing taken over from the banks that owned the properties. We recovered the houses that banks threw us out of or that had been abandoned for years for speculative fallow, we wrested space from capital for life, to continue living.

It was also a matter of demonstrating, once again, that yes we can, that there are thousands of empty houses and that putting them to use with social rents was possible. The structural demand was for a public park with affordable rental housing with the toxic assets payed for by public debt. And while we fought for it, we worked during the worse years of the crisis to return housing’s social function block by block, floor by floor.

Through practical collective work and direct action, new fields of demands were added in regards to housing: for example, the basic provisioning of water, electricity, and gas started being understood as an inseparable part of dignified housing. In the case of extreme poverty that impeded access through legal channels, similar to how houses were recuperated, measures were also taken to guarantee energy access through disobedient means.

Through direct action, taking shelter under material resources taken from capital, and in the framework of a public campaign that insisted “if Bankia is ours [upon being bailed out with public money], its houses are too” (a mass socialization of the property of the rescued banks), something else was also born: a community in struggle thanks to which we have since been able to say “You are not alone” and “In the PAH you will never be left out on the streets”. With time, Obra Social became the entryway to the PAH and the movement for dignified housing for compañeras from very different trajectories. In PAH Vallekas, we do not hesitate to accept new comrades who have moved into an empty flat on their own, having been cheated with an alleged rent in a shared apartment or because they simply did not want to continue living on the street, with the whole family in a rented room, or in an overcrowded relative’s house, or from couch to couch without a place to call home. Soon the Obra Social ceased to be the last alternative for mortgaged comrades and started to be an option for people who had never had mortgages, such as Mina and others who had lived from rent to rent. Participating in the campaign allowed everyone to reduce the cost of living and thus gain a little bit of economic stability and time to struggle. Above all, for many, it was their first time being part of a community in struggle, something that many of us were lacking in many ways. Over time, many of those “toxic assets” that we had turned into homes and spaces of encounter would end up in the so-called “bad bank”.

***

Footnotes

1 See “Asesoría colectiva” in the statewide PAH’s website.

2 “It is very important to recognize that the PAH is not a ‘traditional’ counseling service, in which a person arrives, tells their problem to another more knowledgeable person, and waits for that person to resolve the case. The fact is, we have seen that we need to fight together to achieve results” (Libro Verde de la PAH, p. 12).

3 See, “Dación en pago”, in Wikipedia.

4 See the February 8, 1946 decree and the important modifications in Law 2/1981 of March 25 and Law 41/2007 of December 7.

5 Associació 500×20, “Quita o condonación, total o parcial, de deuda hipotecaria”.

6 For racialized women migrant workers, this meant a clear cocktail of forms of oppression that is not reflected in the expressions used in discourses about gender equality in the workplace, such as “the glass ceiling”. As our racialized feminist compañeras say, “when a white woman breaks the glass ceiling, the one who cleans up the mess is an immigrant or ‘illegal’”, as many of us have been.

7 “Financial planners prefer women, because they recognize that they are more responsible in their economic transactions, being far more dependent on steady economic resources for the reproduction of their families and being more vulnerable to intimidation. They have also studied women’s communities and ‘appropriated their system of social relations for their objectives,’ treating it like a social capital, so that when groups are not available women are encouraged to form them” (Federici, 2019, p. 65, referencing María Galindo, 2010, p. 10).

8 The PP and Ciudadanos overturned the legislative proposal on November 8, 2017. See Ter García (2017): “PP y Ciudadanos tumban la ILP de vivienda de Madrid”, in El Salto, November 8.

9 See, “1998-1999 Ecuador Economic Crisis”, in Wikipedia.

10 Daniel Camargo was a pedophile who carried out multiple rapes in Colombia and Ecuador. He died in 1994.

11 See, for example Caballero, Fátima (2019): “El final de una polémica venta con la que Ignacio González intentó hacer caja en lo peor de la crisis”, in El Diario, December 12: and Rincón, Reyes, and Juan José Mateo (2019): “El Supremo confirma la nulidad de la venta de 3.000 pisos de la Comunidad de Madrid a un fondo buitre”, in El País, December 13.

12 “It also caused ‘an unjustifiable impairment of public assets’ of more than 22 million Euros” (León, Pablo, 2018: “Botella y 7 excargos de Madrid, condenados a pagar 26 millones por malvender pisos públicos a fondos a fondos buitres”, in El País, December 28).

13 Financial deregulation had already in 1985 with Royal Decree-Law 2/1985, better known as the Boyer Law. Based on these provisions, among others, the PSOE’s Economic Ministry modified urban lease law in 1994 in a way that was detrimental to the lessor. In 1996, with the PP government, the land law comes into effect and with it, real estate valuation became more flexible in 2003 with Order ECO/805/2003, thus enabling the creation of the real estate bubble.

14 The European Union itself listed actions, which, had they been taken by the Central Bank, would have prevented the bubble. Among others, “during the real estate expansion, it allowed banks and savings banks to give mortgages for an amount equivalent of 120 porcent or more of a house’s value and did not impose strict limits on entities to avoid the excessive concentration of loans in the real estate sector” (Oliveras Bruselas, Eliseo, 2010: “El Banco de España falló ante la burbuja inmobiliaria, según la UE”, in El Periódico, December 15).

15 In the blog of the statewide PAH, the vote was described with these words: “This Tuesday, admitting the ILP procedure is being voted on. Vote if you can. What is being voted on is to either recognize or disregard the work of thousands of people who have collected signatures for this ILP, of the hundreds of thousands who have signed it, of the hundreds of thousands affected by it. The definitive discrediting of certain political groups or demonstrating the political will of listening to citizen demands is being voted on. […] The PP has announced that it will vote against the initiative. This decision is incompatible with the defence of human rights. It responds to the interests of lobbying groups tied to financial entities, many of whom were bailed out with public money, and continue enriching themselves and evicting thousands of families in our country” (“Concentraciones frente a las sedes del PP y el Congreso”, February 12, 2013).

16 The Bank of Spain Circular 5/1994 created the Mortgage Loan Reference Index (IRPH). There are three types for operations for more than three years: banks, savings banks, and groups of entities. The key to the banking abuses through the IRPH lies in the opacity of individual operations and the lack of supervision, which make the index easy to manipulate. See, the judgment of the European Union Court of Justice on March 3, 2020.

17 For more information, see the page of the PAH’s Obra Social campaign.

18 See, “Sistema institucional de protección” in Wikipedia.

19 See, Article 25 of Royal Decree-Law 6/2010, from April 9, on measures to promote economic recovery and employment.

20 Along with Caja Madrid, the savings banks in question were Bancaja, Caja de Canarias, Caja de Ávila, Caixa Laietana, Caja Segovia, and Caja Rioja.

21 See, Royal Decree-Law 9/2009, from June 26.

22 For more details, see “Bankia” in Wikipedia. The Anti-Corruption Prosecutor’s Office took this to trial for “taking an entity with a fictitious overvaluation to the stock market, the imposing advertising campaign to attract investors or to maintain the fiction of the viability of the parent company after going public, cannot be considered business errors. In this sense, it can be assured that it was a whole ‘tactic’ used by the managers to maintain their positions and privileges” (Antequera, José, 2019: “Salida a bolsa de Bankia: una estafa planeada para mantener los privilegios de las élites corruptas”, In diario16.com, September 10). Rato was acquited in 2020 because the Bank of Spain, the National Security Markets Commission (CNMV), the Fund for Orderly Bank Restructuring (FROB), and the European Banking Authority (EBA) had given the go-ahead on the operation; compare with footnote 14 for a good example of how institutions blamed one another for the financial swindle and subsequent social crisis.

23 Although on a historical scale this is nothing new, rather they now replicate on the European continent the neoliberal horrors experienced in Africa and South America in earlier decades.

24 The complete quote to which we refer is: “The decision to bail out banks but not working-class debtors has it made it clear that debt is designed to be a standard condition of working-class existence” (Federici, Silvia. 2019. Re-enchanting the World: Feminism and the Politics of the Commons. Oakland, CA: PM Press.)